Cash discount programs are a way to pass on the credit card processing fees to the consumers, and have been increasingly popular amongst businesses. This program helps to implement a service fee to those who pay for their purchases via credit card. On the other hand, the program offers a discount to those who make payment with cash. Within all 50 states in the U.S., cash discount programs are legally permissible according to the Durbin Amendment which states that businesses are able to incentivize consumers through providing a discount when they pay with cash. Although many businesses like gas stations have implemented cash discount programs for a long time, it may still be confusing for some business owners on how they should implement the programs the right way.

Guidelines for Implementing Cash Discount Programs

Strict guidelines must be adhered to if business owners want to implement a cash discount program. Firstly, the appropriate signage signaling that the business has implemented a cash discount program must be placed at the door and the check-out counter of the store. Secondly, the amount borne by the consumer must be printed clearly on the receipt. Thirdly, you need to offer consumers a cash discount verbally. Although certain businesses like the gas station post different prices, it is not necessary for a retailer to do so. For a retail store to be compliant, business owners must show specific details on the customers’ receipts. This includes the cash discount, the base amount and the final total cost of the entire transaction.

Application of the Service Fee

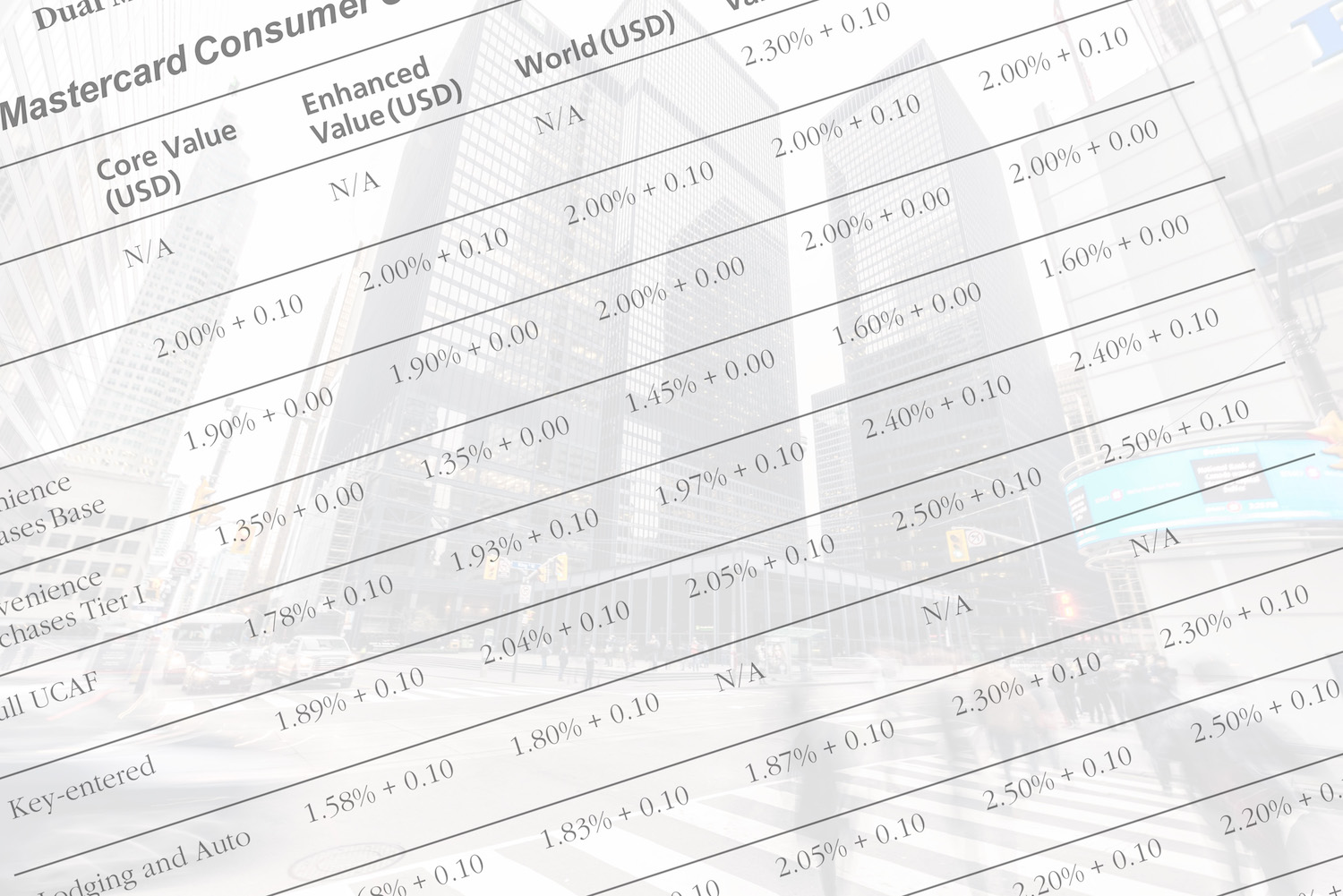

If your terminal is not properly programmed, service fees need to be applied manually by your staff. However, if the service fee is applied incorrectly in a transaction, the fee could be labeled as a surcharge. Surcharges are legally prohibited in 10 states within the U.S., including Florida, Maine, Oklahoma, Texas, Colorado, Massachusetts, Connecticut, New York, California and Kansas. Even if it is legally permissible in some states, additional fees that are not qualified as cash discounts are considered surcharges. Every state has strict requirements on the amount of surcharge retailers can apply. To legally apply a surcharge, merchants must be registered with MasterCard and Visa. No registration is necessary for cash discount programs.

Technology

Another important thing to know is that it is illegal for a retailer to profit off a credit card transaction. This could happen if you have unintentionally charged more than the amount your processor has charged you. Although cash discount programs are offered by many processors, some may not have the technology that is compatible and compliant with the terminals you use in the store.

Another key point to take note of is the cash discount line item. Sometimes, processors offer programs where the cash discount line item does not show on the receipt. Hence, when you are looking for a processor, ensure that they offer a program compliant with the law and has the necessary technology to display all required and relevant information on the receipt.

Looking to implement a cash discount program to your business? Look no further than Titan Merchant Services. We are a provider that is compliant to the law, and provides reliable services and products to different retailers. With 30 years of experience, you do not have to worry about compliance as we can advise you about the different guidelines you should take note of. Feel free to contact us if you have any questions today!